Stonewell Bookkeeping for Beginners

Getting My Stonewell Bookkeeping To Work

Table of ContentsStonewell Bookkeeping Things To Know Before You BuyNot known Incorrect Statements About Stonewell Bookkeeping See This Report on Stonewell BookkeepingGetting My Stonewell Bookkeeping To WorkThe Only Guide to Stonewell Bookkeeping

Instead of going through a filing cabinet of different records, invoices, and receipts, you can offer comprehensive records to your accountant. In turn, you and your accounting professional can conserve time. As an included incentive, you might also be able to identify potential tax write-offs. After utilizing your accountancy to submit your tax obligations, the internal revenue service may select to do an audit.

That financing can come in the type of proprietor's equity, grants, business car loans, and financiers. Financiers need to have a great idea of your organization prior to investing. If you don't have accountancy records, financiers can not establish the success or failing of your firm. They need updated, accurate details. And, that details requires to be easily obtainable.

Stonewell Bookkeeping for Beginners

This is not meant as lawful recommendations; to find out more, please go here..

.jpg?token=7cd2150746d7a6091d181e6f1b4de871)

We answered, "well, in order to understand just how much you need to be paying, we need to know just how much you're making. What are your profits like? What is your net income? Are you in any financial obligation?" There was a long pause. "Well, I have $179,000 in my account, so I guess my earnings (profits much less expenses) is $18K".

A Biased View of Stonewell Bookkeeping

While it could be that they have $18K in the account (and even that could not be real), your equilibrium in the financial institution does not always determine your revenue. If somebody obtained a give or a financing, those funds are not thought about profits. And they would not work into your earnings statement in identifying your profits.

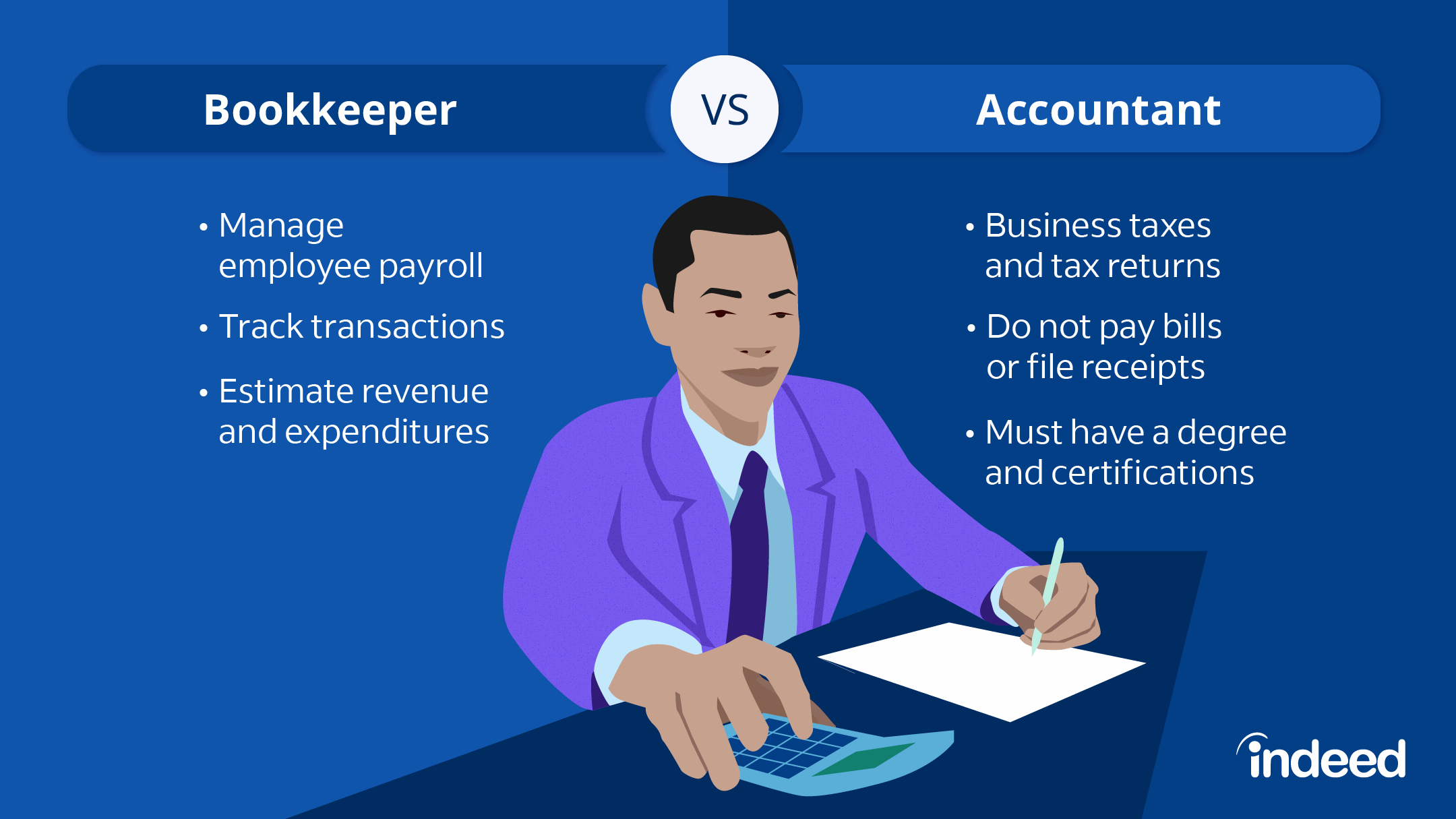

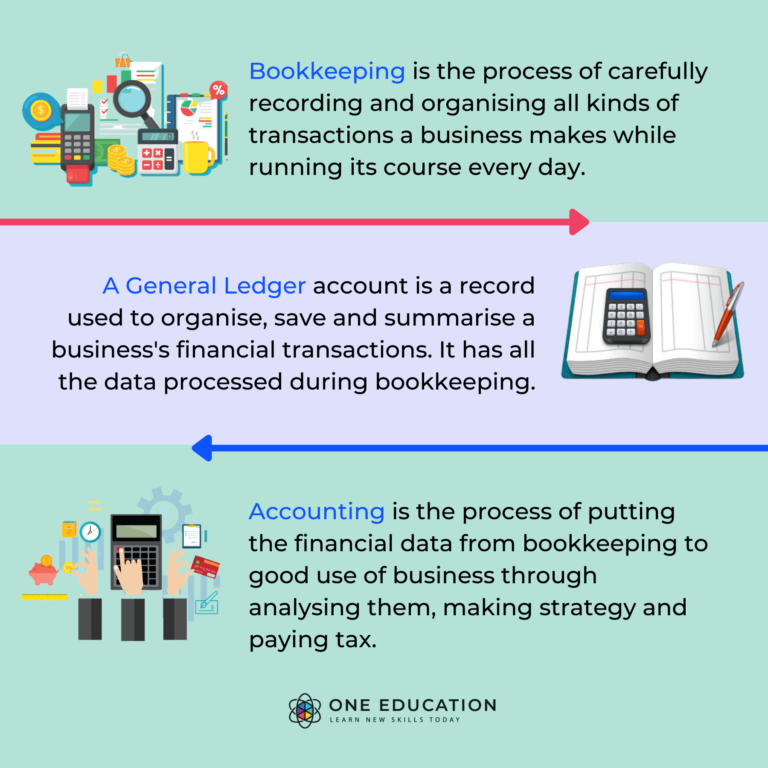

Numerous things that you think are costs and reductions are in truth neither. Bookkeeping is the procedure of recording, identifying, and arranging a company's monetary transactions and tax obligation filings.

A successful organization requires aid from specialists. With practical goals and a qualified bookkeeper, you can quickly deal with difficulties and maintain those concerns at bay. We devote our energy to guaranteeing you have a solid monetary foundation for growth.

The Basic Principles Of Stonewell Bookkeeping

Accurate bookkeeping is the backbone of good financial management in any kind of company. With excellent bookkeeping, services can make better choices because clear economic documents offer valuable information that can assist strategy and enhance earnings.

Meanwhile, solid accounting makes it simpler to secure financing. Precise monetary statements construct trust fund with lenders and financiers, boosting your possibilities of obtaining the resources you require to expand. To preserve solid economic wellness, organizations must routinely reconcile their accounts. This means matching deals with bank statements to capture errors and prevent economic discrepancies.

A bookkeeper will go across financial institution declarations with inner records at least as soon as a month to locate blunders or inconsistencies. Called financial institution settlement, this process ensures that the economic records of the firm suit those of the financial institution.

They monitor existing pay-roll data, deduct taxes, and number pay scales. Bookkeepers produce standard monetary records, consisting of: Profit and Loss Statements Shows income, expenditures, and web profit. Balance Sheets Details possessions, obligations, and equity. Cash Flow Statements Tracks money motion in and out of the business (https://www.openstreetmap.org/user/hirestonewell). These reports aid company owner understand their economic placement and make informed decisions.

How Stonewell Bookkeeping can Save You Time, Stress, and Money.

While this is economical, it can be lengthy and susceptible to mistakes. Devices like copyright, Xero, and FreshBooks permit organization proprietors Clicking Here to automate bookkeeping tasks. These programs aid with invoicing, bank settlement, and monetary coverage.